Investing in the stock market and mutual funds presents an opportunity for long-term wealth accumulation. However, the investment approach adopted significantly influences returns and associated risks. Two commonly employed methods are lump sum investing and Systematic Investment Plan (SIP). Although lump sum investing may attract those seeking to invest a substantial amount at once, it entails higher risks compared to SIP, where investors make periodic, smaller contributions.

Here's why monthly SIPs offer a more favorable risk profile than lump sum investing.

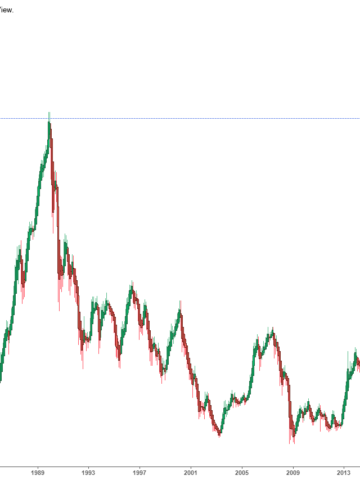

1. Market Timing Risk: Lump sum investing presents a significant challenge in timing the market accurately. A substantial one-time investment is vulnerable to substantial losses if the market experiences a sudden decline. Given the inherent volatility of the stock market, accurately predicting short-term movements is nearly impossible.

In contrast, SIP mitigates this risk by spreading investments over time. By making regular, smaller contributions, investors are less exposed to market fluctuations, enabling them to purchase more shares when prices are low and fewer when prices are high, a strategy known as rupee cost averaging.

2. Volatility and Emotional Stress: Market fluctuations can induce panic, particularly for investors who have made a large one-time investment. Witnessing significant short-term losses may lead to impulsive decisions such as selling during a downturn, crystallizing losses, or exiting the market altogether.

SIP minimizes the impact of market volatility by exposing only a small portion of the total investment at any given time. This reduces emotional stress, facilitating adherence to the long-term investment strategy.

3. Risk of Capital Loss: With lump sum investing, the entire investment is immediately subjected to market risk. If the market moves unfavorably post-investment, the entire amount could be at risk of substantial losses.

Conversely, SIP spreads the investment over an extended period, significantly reducing the potential for large capital losses in the event of a sudden market drop.

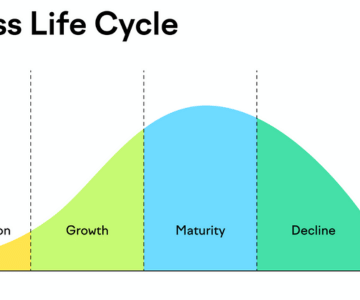

4. Discipline and Long-Term Focus: SIP instills financial discipline by encouraging investors to allocate a fixed sum each month towards their financial goals. This consistent approach can yield better long-term returns.

In contrast, lump sum investors may struggle to time re-entry or exit from the market once the initial investment is made. SIP fosters a disciplined approach, crucial for long-term wealth accumulation.

5. Affordable and Accessible: SIPs are more affordable and accessible for retail investors with limited funds. With contributions as low as ₹500 or ₹1,000 per month, SIP serves as a low-barrier entry point for novice investors.

In contrast, lump sum investing typically requires a substantial capital outlay. In conclusion, SIPs offer an advantageous risk profile over lump sum investing, making them suitable for long-term wealth-building goals.

6. Compounding Effect: The allure of investing lies in the concept of compounding—the capacity of investments to generate earnings, which are subsequently reinvested to generate further earnings. Systematic Investment Plans (SIPs) facilitate regular contributions, with each installment commencing compounding upon investment. Over an extended period, this has the potential to lead to substantial wealth accumulation.

Although lump sum investments also benefit from compounding, the ability to consistently add to investments through SIPs maximizes the potential for compounding growth, regardless of market conditions at the outset.

Conclusion: While lump sum investments may yield high returns in a bullish market, they entail significant risks, particularly in volatile or uncertain market conditions. Conversely, SIPs offer a more secure and disciplined approach to long-term wealth accumulation. By spreading investments over months or years, SIPs mitigate the risk of market timing, reduce emotional stress, and enable investors to benefit from rupee cost averaging. For most retail investors, SIPs provide an affordable and effective means of achieving long-term financial objectives without assuming unnecessary risk. In essence, SIPs represent an optimal choice for risk-averse investors seeking a stable, systematic, and stress-free approach to wealth creation.

Gain valuable insights into your equity portfolio with our research reports. Contact aaron@neuralbahn.com to take your investment strategy to the next level.

www.neuralbahn.com