In recent decades, there has been a heightened discourse on the comparative efficacy of value investing, growth investing, and other forms of active investing relative to passive investing. Investors are consistently evaluating the advantages of striving to outperform the market through active strategies versus attaining market performance parity through passive investments. However, an accumulating body of evidence indicates that active investing, whether value-driven, growth-focused, or involving tactical asset selection, tends to exhibit underperformance relative to passive investing over extended time horizons.

Understanding Active Investing : Active investing encompasses a strategy wherein fund managers or individual investors make decisions pertaining to the purchase or sale of stocks in an endeavor to surpass market performance. This can manifest as: - Value investing, entailing the selection of stocks based on perceived undervaluation. - Growth investing, centering on companies anticipated to experience above-average growth rates. These strategies necessitate substantial research, analysis, and discernment to identify market opportunities that are not fully reflected in prices. The overarching objective is to "outperform the market," often benchmarked against relevant indices such as the S&P 500 or Nifty 50.

Understanding Passive Investing : Conversely, passive investing involves participation in funds mirroring the performance of a market index. Notable vehicles for passive investing encompass index funds and exchange-traded funds (ETFs). These funds are designed with a simpler objective: to track market performance, rather than surpassing it.

Factors Contributing to the Underperformance of Active Investing

1. Elevated Costs: Active investing necessitates continual research, portfolio adjustments, and transaction fees. The costs associated with managing active funds, encompassing management fees and transaction costs, notably exceed those of passive funds. Over time, these expenses erode returns. For instance, according to Morningstar, the expense ratio of actively managed equity funds averages approximately 0.66%, while index funds exhibit a lower average cost of around 0.12%. Despite appearing marginal, this disparity accrues over time and significantly impacts total returns.

2. Market Efficiency: The stock market has increasingly exhibited efficiency, rendering it more challenging for fund managers to identify mispriced stocks. Information is widely accessible and promptly priced into stocks, leaving minimal room for outperformance. Multiple studies have underscored the substantial influence of the efficient market hypothesis (EMH) in this context. EMH posits that all available information is already reflected in stock prices, making it exceedingly arduous for active managers to consistently pinpoint undervalued or overvalued stocks.

3. Inconsistent Performance: Even when active managers surpass the market in certain years, their outperformance is frequently erratic. Few managers can consistently outperform their benchmarks over protracted durations. For instance, reports from SPIVA (S&P Indices Versus Active) consistently demonstrate that over a 10-year period, more than 80% of actively managed large-cap funds underperform their benchmarks. In the context of India, as of 2024, over 85% of large-cap mutual funds failed to outperform their benchmark index over a five-year timeframe.

4. Behavioral Biases: Active investing is susceptible to behavioral biases such as overconfidence, herding behavior, and short-term focus. These cognitive biases can lead to suboptimal decision-making and frequently culminate in inferior returns relative to merely tracking the market.

Growth vs. Value: Relevance for Active Investing

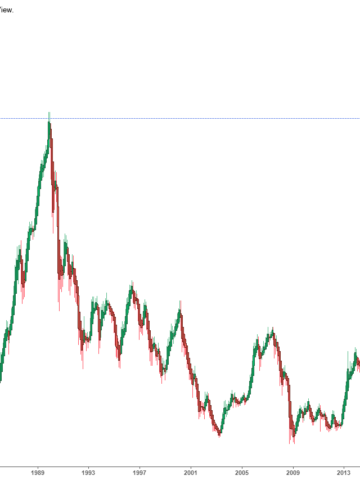

Both growth and value investing exhibit distinct periods of outperformance; however, neither style has consistently surpassed passive strategies. Growth investing typically excels during bullish market phases, while value investing often outperforms during economic recoveries or bear markets. Nonetheless, accurately timing these transitions is exceedingly challenging, and most active managers struggle to do so consistently.

Value Investing: Championed by illustrious investors such as Warren Buffett, value investing aims to capitalize on market inefficiencies by acquiring undervalued companies. While value strategies have experienced periods of robust performance, studies indicate that value-focused active funds also underperform passive benchmarks over protracted periods.

Growth Investing: This approach targets companies expected to exhibit faster growth than the market. Growth stocks often excel in burgeoning economies; however, they may also undergo substantial downturns when market sentiment shifts. Analogous to value strategies, actively managed growth funds frequently lag behind passive benchmarks in the long run.

The Emergence of Passive Investing

Passive investing has gained significant traction due to its cost-effectiveness, transparency, and straightforward nature. As investors have grown more cognizant of the consistent underperformance of active funds, a substantial number have transitioned to index funds and exchange-traded funds (ETFs), which mirror major indices and provide diversified exposure to markets without necessitating continual oversight. For example, the Vanguard S&P 500 Index Fund has consistently yielded returns closely aligned with the S&P 500, surpassing the majority of actively managed large-cap funds in both the U.S. and globally.

Conclusion: The Advantages of Passive Investing

Although both value and growth investing possess their respective merits, they frequently lag behind passive investing due to elevated costs, market efficiency, and the unreliability of active fund managers. The evidence is unequivocal: over the long term, active management, irrespective of strategy, generally lags behind passive investing. For the average investor, adhering to low-cost index funds that offer comprehensive market exposure and circumvent the pitfalls of exorbitant fees and human fallibility is often the most prudent course of action. As the market continues to evolve and access to information proliferates, the appeal of passive investing is poised to expand even further.

Gain valuable insights into your equity portfolio with our research reports. Contact aaron@neuralbahn.com to take your investment strategy to the next level.

www.neuralbahn.com