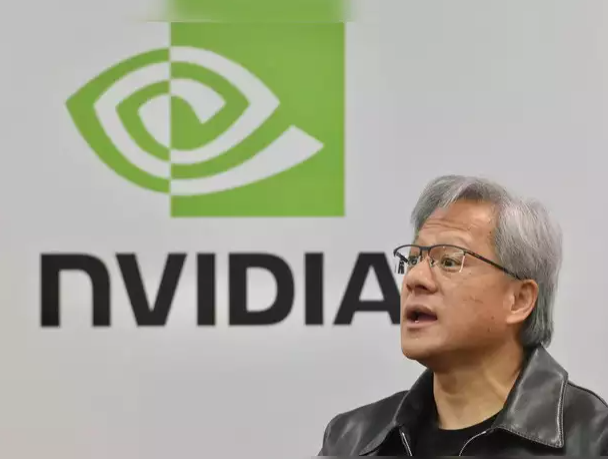

NVIDIA, the prominent graphics processing unit (GPU) leader, currently holds a significant position in the artificial intelligence (AI) industry. Its robust GPUs serve as the cornerstone of AI computation, spanning from deep learning to autonomous driving. Nonetheless, historical evidence suggests that companies like NVIDIA, which primarily focus on providing foundational architecture for a technological revolution, may not ultimately secure long-term dominance. Instead, the most successful entities often emerge as those leveraging the architecture to offer transformative products and services. Historical insights indicate reasons why NVIDIA might not emerge as the ultimate victor in the AI race.

The Architectural Dilemma: Provision of Infrastructure vs. Reaping the Rewards

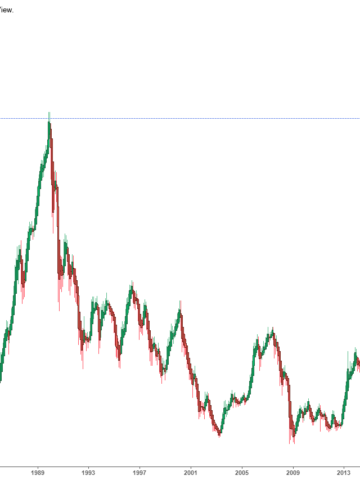

During technological revolutions, companies that furnish fundamental infrastructure typically experience initial benefits but are subsequently overshadowed by those who leverage the infrastructure to introduce groundbreaking products. Consider Intel during the personal computer (PC) revolution. Intel dominated the semiconductor space with its x86 processors, which powered the majority of the world’s PCs. However, the true revolutionaries in computing—such as Apple and Microsoft—were the companies that constructed software ecosystems and consumer-oriented products on Intel's architecture. While Intel remains an enormously successful company, it did not shape the cultural and business paradigm of computing to the extent achieved by these end-product companies.

NVIDIA as an AI Enabler, Not a Product Innovator

NVIDIA currently finds itself in a comparable position. Its GPUs are indispensable for training AI models, thereby serving as the "picks and shovels" in the ongoing AI gold rush. However, NVIDIA’s role primarily revolves around enabling others to develop transformative AI products through the provision of computational power. Much like Intel during the PC era or ARM during the mobile revolution, NVIDIA’s emphasis on architectural creation places it as a technological facilitator, rather than the company that will revolutionize the impact of AI on everyday life. The true value may not be captured by the company providing processing power, but rather by the organizations creating AI-driven products that significantly impact people’s lives—such as autonomous vehicles, personalized healthcare, or intelligent assistants.

Value Creation Occurs at the Product Level

The companies utilizing AI to address real-world issues—such as Google, Amazon, and Tesla—are poised to generate more value than firms solely focused on hardware. These companies leverage AI to enhance their products and services, thereby improving user experiences and fostering novel revenue streams that drive global transformation. - Google is revolutionizing search, advertising, and natural language processing (NLP) with AI. Its AI models are integrated into products such as Google Assistant, YouTube, and Gmail. - Amazon utilizes AI to streamline logistics, recommend products, and power its voice assistant Alexa. - Tesla is employing AI to develop autonomous vehicles, which could redefine transportation. Although NVIDIA plays a critical role in enabling these AI advancements, it is these end-product companies that are likely to capture the most value, as they are the ones applying AI to create disruptive, consumer-oriented innovations.

Commoditization of AI Hardware

NVIDIA faces the risk of the commoditization of AI hardware. In many technological revolutions, infrastructure that was once cutting-edge eventually becomes commoditized. This trend has been observed in processors, storage, and even the cloud. Over time, as competitors enter the market, innovation slows, prices decline, and margins narrow. Competitors such as Google’s Tensor Processing Units (TPUs), AMD, and new entrants in the AI chip industry could exert pressure on NVIDIA’s dominance. As AI hardware becomes more commoditized, the differentiating factor will shift from the power of the architecture to the applications built on it. The companies that develop distinctive products and experiences using AI—rather than those selling the tools to do so—are likely to emerge as the major winners.

Vertical Integration: A Potential Threat

Vertical integration poses another threat to NVIDIA's long-term success in AI. Companies such as Google, Amazon, and Apple have initiated the development of their own custom chips tailored specifically for their products, thereby reducing their reliance on third-party architecture providers like NVIDIA. For instance, Google’s TPUs are custom-designed to handle the company’s specific machine learning workloads, making them more efficient for certain AI applications. Similarly, Apple's M1 chip for Macs and mobile devices exemplifies how vertical integration can enhance performance and optimize products. This move toward vertical integration mirrors previous technological revolutions, wherein companies that created custom hardware for their own software ecosystems—such as Apple—ultimately dominated the landscape.

Lessons from History: The Real Champions of Technological Revolutions

History provides abundant evidence that the companies controlling the architecture often do not end up dictating the future. Here are two key examples: - Microsoft and IBM: In the early stages of personal computing, IBM dominated the market with its hardware, but it was Microsoft’s Windows operating system that became ubiquitous, propelling Microsoft’s dominance for decades. - ARM and Apple: ARM developed the architecture that powers nearly all mobile devices, yet it is companies like Apple and Google that have built ecosystems and products that have transformed society. In both instances, the companies that capitalized on the underlying architecture, thereby generating value for end users, were ultimately the ones that reaped the most significant benefits.

Conclusion: NVIDIA’s Role in AI May Be Temporary

While NVIDIA currently occupies a pivotal role in the field of AI by supplying the potent GPUs that drive AI progress, its enduring supremacy is not guaranteed. Historical precedent demonstrates that the principal beneficiaries of technological revolutions are typically not the entities responsible for constructing the architecture, but rather those that leverage said architecture to deliver transformative products and services. As AI continues to evolve, it is anticipated that the organizations utilizing AI to devise innovative, consumer-centric solutions will likely shape the future and capture the lion's share of value. Companies such as Google, Amazon, Tesla, and others, harnessing AI to disrupt industries and enhance everyday life, may emerge as the ultimate victors, while NVIDIA, notwithstanding its current dominance, may find itself as a crucial, yet not definitive, enabler in the AI revolution.

Gain valuable insights into your equity portfolio with our research reports. Contact aaron@neuralbahn.com to take your investment strategy to the next level.

www.neuralbahn.com