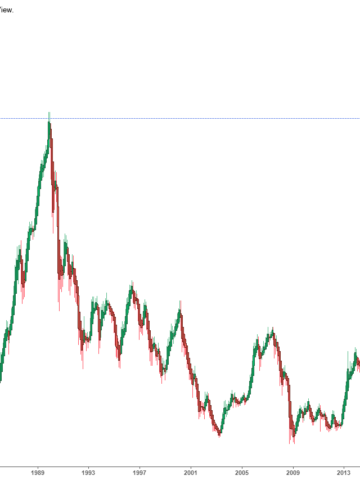

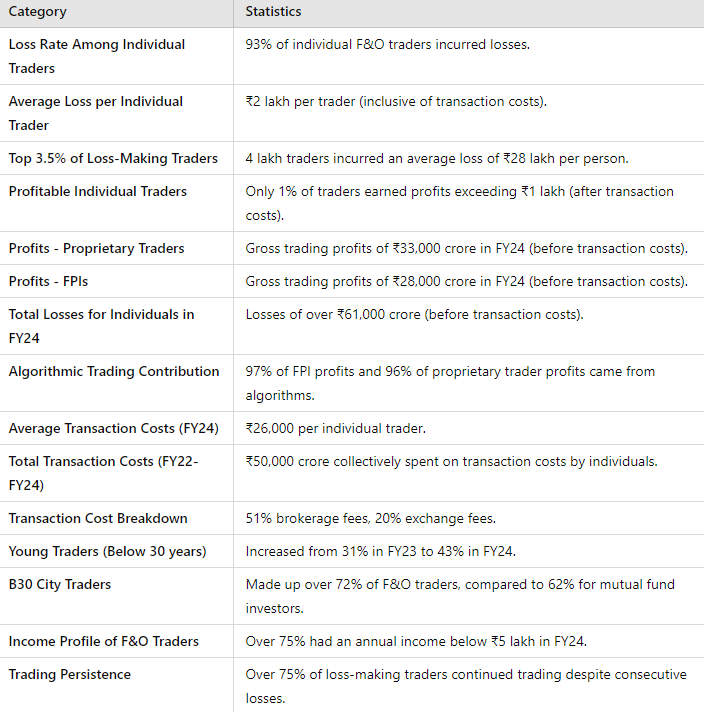

Regrettably, a recent Securities and Exchange Board of India (SEBI) study has unveiled a disheartening reality for individual traders in the equity futures and options (F&O) market. The study, analyzing trading patterns between FY22 and FY24, disclosed that an overwhelming 93% of individual traders in the F&O segment incurred substantial losses, with average losses amounting to approximately ₹2 lakh per trader. For a subset of traders, the losses were even more severe, with the top 3.5% of loss-makers averaging ₹28 lakh per person. This data underscores a crucial message – F&O trading is not a viable wealth-building strategy for the majority of individuals. Instead, directing attention towards long-term investing in stocks or mutual funds may provide a more secure and sustainable path to financial growth.

High Risk, Low Reward: The Pitfalls of F&O Trading

F&O trading, being intricate and speculative, frequently entices individuals with the allure of substantial returns. However, the SEBI study reveals that only 1% of traders managed to achieve profits exceeding ₹1 lakh after factoring in transaction costs. This remarkably low success rate signifies that F&O trading presents a high-risk venture where individual traders face substantial odds. The issue is further compounded by the elevated transaction costs in F&O trading. On average, traders expended ₹26,000 on transaction fees in FY24 alone, contributing to a total of ₹50,000 crore in costs over the three-year period. With over half of these costs attributed to brokerage fees, even minimal gains can swiftly diminish, rendering it challenging for individual traders to break even, let alone realize profits.

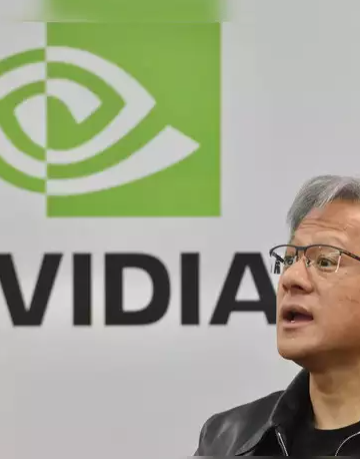

Why Professional Traders Thrive and Individuals Don't ?

Intriguingly, while individual traders endure losses, proprietary traders and Foreign Portfolio Investors (FPIs) consistently reap substantial profits in the F&O market. In FY24, proprietary traders accrued gross profits of ₹33,000 crore, and FPIs garnered ₹28,000 crore, primarily owing to their reliance on algorithmic trading. According to SEBI, 97% of FPI profits and 96% of proprietary trader profits emanated from algorithmic trading, a strategy that furnishes significant leverage to large institutional players over individual investors. This disparity in outcomes between professional and individual traders underscores a pivotal point – the F&O market is dominated by large entities equipped with advanced tools and strategies. Individual traders, often lacking the sophisticated algorithms and market insights of these larger players, find themselves at a significant disadvantage.

The Psychological Trap of Losses

The SEBI study also sheds light on the persistence of individual traders despite recurrent losses. More than 75% of loss-making traders continued to engage in F&O trading year after year, a phenomenon explicable through behavioral finance. Many traders succumb to the psychological trap of attempting to recoup their losses, believing that they can reverse their fortunes with just one more trade. Unfortunately, this often leads to even greater losses over time.

A Better Alternative: Long-Term Investing in Stocks and Mutual Funds

In contrast to the speculative nature of F&O trading, long-term investing in stocks or mutual funds offers a more stable and rewarding approach. Historically, equity markets have yielded consistent returns over the long run, benefiting investors who exhibit patience in weathering short-term market fluctuations. Investing in stocks enables individuals to become stakeholders in companies, reaping the benefits of their growth, dividends, and market appreciation. Mutual funds, especially equity and index funds, bestow diversified exposure to the market, mitigating risk while proffering steady returns. The power of compounding, where returns generate further returns, constitutes a significant advantage in long-term investing - an advantage absent in F&O trading, which concentrates on short-term price movements.

Lower Costs, Greater Returns

Another compelling rationale for selecting long-term investing over F&O trading is the reduced cost structure. Mutual funds and direct stock investments typically entail lower transaction costs compared to F&O trading, where brokerage, exchange fees, and other charges rapidly accumulate. The SEBI study revealed that individual F&O traders expended billions on transaction fees over three years – costs that could have been averted through long-term investments.

Financial Security Over Speculation

For the majority of individuals, the objective of investing is to amass wealth for long-term aspirations such as retirement, homeownership, or education funding. F&O trading, with its high risk and low success rate, is unsuitable for these purposes. Conversely, long-term investing in stocks and mutual funds aligns with the principle of financial security, offering consistent growth and compounding returns devoid of the emotional and financial strain associated with short-term speculation.

Conclusion - Opt for Investment Rather Than Speculation

The evidence is unequivocal: F&O trading yields negative outcomes for the majority of individual investors. With 93% of traders experiencing losses and only a small minority achieving nominal gains, the associated risks far outweigh the potential rewards. Conversely, long-term investment in stocks or mutual funds presents a validated route to wealth accumulation. Instead of wagering on short-term market fluctuations, individuals would be better served by embracing a methodical, patient approach to investing that prioritizes sustained growth and financial stability.

Gain valuable insights into your equity portfolio with our research reports. Contact aaron@neuralbahn.com to take your investment strategy to the next level.

www.neuralbahn.com