Growth stocks and value stocks are distinct categories utilized by investors to categorize companies based on their defining attributes, financial performance, and market perception. The following elaborates on the differences between them:

neuralbahn.com

Growth Stocks

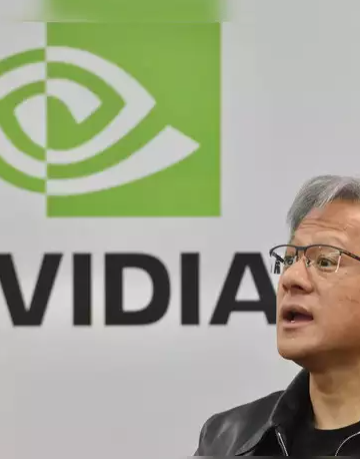

Growth stocks represent companies expected to surpass overall market growth. These enterprises typically reinvest their earnings into expansions, research and development, and other growth prospects instead of distributing dividends to shareholders.

Characteristics of growth stocks:

- High Growth Potential: These companies often operate in high-innovation sectors such as technology or biotechnology, with the expectation of exceeding average revenue and earnings growth.

- Elevated Valuations: Growth stocks typically exhibit high price-to-earnings (P/E) ratios as investors are willing to pay a premium for their potential for future growth.

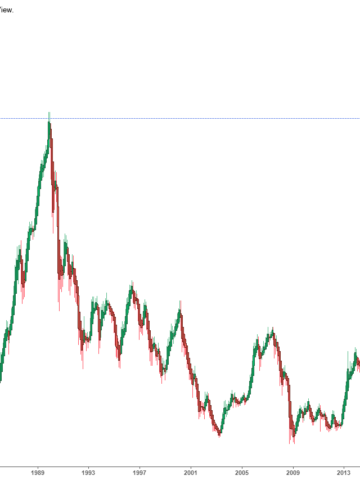

- Volatility: Given that their value closely hinges on future growth expectations, they are more susceptible to market fluctuations. Failure to meet these expectations can lead to significant declines in stock prices.

- Dividends: Growth companies frequently forgo paying dividends, choosing instead to reinvest profits into the business to fuel further growth.

Value Stocks

Value stocks are indicative of companies considered undervalued in the market. These stocks generally feature lower price-to-earnings (P/E) ratios and may be overlooked by the market due to transient issues or negative sentiment.

Characteristics of value stocks:

- Stable or Moderate Growth: These companies typically demonstrate more consistent, predictable earnings and generally slower growth rates compared to growth stocks.

- Lower Valuations: Value stocks often display lower P/E ratios, price-to-book (P/B) ratios, and other valuation metrics, making them appear "inexpensive" relative to their intrinsic value or the broader market.

- Dividends: Many value stocks issue dividends, providing routine income to investors, as these companies may have more mature business models and generate steady cash flows.

- Less Volatility: Value stocks are generally perceived as less volatile than growth stocks since their prices are often more aligned with the company's current fundamentals rather than future prospects.

Key Differences

Growth Stocks focus on capital appreciation and long-term growth potential, while Value Stocks focus on capital preservation, dividend income, and moderate growth.

Growth Stocks come with heightened risk due to their dependence on future growth expectations, while Value Stocks have a lower risk profile due to more stable earnings, often emphasizing income generation.

Growth Stocks provide infrequent dividend payments; profits are reinvested for growth. Value Stocks, on the other hand, declare frequent dividend payments to return value to shareholders.

Growth Stocks perform better in bullish markets with heightened investor confidence, while value stocks tend to perform better in uncertain or bear markets when investors seek stable, safer investments.

Both growth and value stocks warrant inclusion in a diversified investment portfolio. The decision between them hinges on an investor's risk tolerance, investment goals, and market outlook. While growth stocks offer the potential for substantial returns but come with elevated risk, value stocks provide stability and income but may involve slower growth prospects.