Averaging down, the practice of purchasing additional shares of a declining stock in order to lower the average cost, may appear enticing at first glance. However, it is a high-risk strategy that frequently leads to exacerbated financial losses.

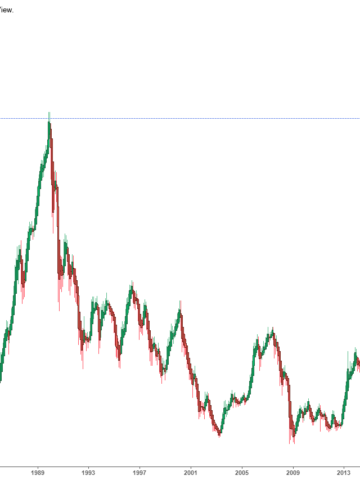

1. Catching a Falling Knife: Stocks typically experience declines for substantive reasons. By acquiring more shares as their value diminishes, investors increase their vulnerability to a stock that may persist in declining.

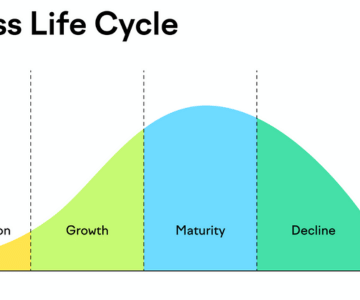

2. Missed Opportunities: Every capital injection into a depreciating stock could be strategically allocated to more robust and expanding enterprises.

3. Emotional Investing: Averaging down often emanates from emotional bias, with investors being reluctant to acknowledge their misjudgment and instead anticipating a reversal in stock performance.

4. Compounding Losses: Persisting declines in the stock value lead to escalated losses, particularly if the company's underlying fundamentals are deteriorating.

5. Fundamental Changes: Stock devaluations frequently stem from bona fide issues. Disregarding these can lead to exacerbated predicaments, with the stock failing to recover.

At Neuralbahn, our primary focus lies in minimizing opportunity costs. Following a thorough assessment of a stock's financial statements to ensure they meet our stringent fundamental analysis criteria, we subject them to evaluation for opportunity costs using our exclusive machine learning algorithms.

If you wish to assess the stocks in your portfolio, please feel free to get in touch with us at aaron@neuralbahn.com

www.neuralbahn.com