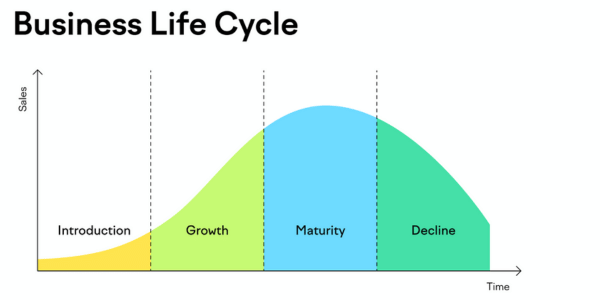

Index investing, particularly in passive funds such as the S&P 500, has witnessed significant growth in popularity over the past few decades. These funds provide benefits that include low fees, extensive market exposure, and a passive approach to investment management, rendering them attractive to both retail and institutional investors. Nevertheless, as with any investment strategy, inherent risks are associated with index investing. While it may appear to be a prudent choice, there exist concealed risks that could lead to unforeseen financial setbacks. This document presents a thorough examination of some potential pitfalls associated with index investing and explores why certain investors may prefer a more nuanced approach.

1. Concentration Risk

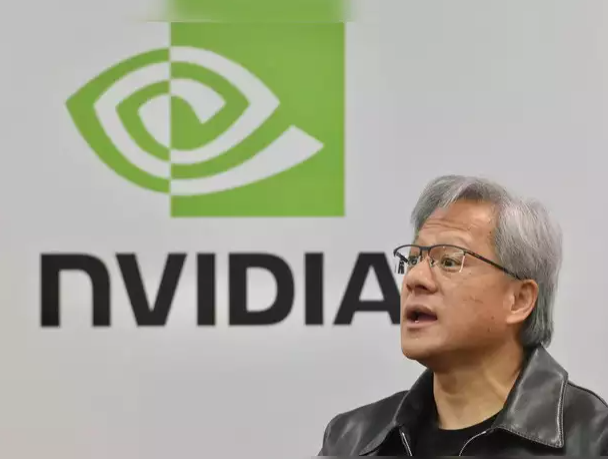

A significant but often overlooked risk in index investing is the concentration of weight in a small number of high-performing stocks. In recent years, for instance, the S&P 500 has increasingly been dominated by technology and AI-driven companies like Apple, Microsoft, and Amazon. While these companies have contributed significantly to overall growth, their dominance also introduces a higher risk of concentration. If these companies or the AI sector experience downturns, the entire index could be adversely affected. Historically, different sectors rise and fall in popularity. In the early 2000s, energy stocks were dominant, while today, technology and AI companies lead the market. However, sector dominance can be cyclical, and the higher the concentration of specific sectors, the greater the risk that a downturn in that sector could negatively impact the overall index.

2. Market Risk

Although index investing provides diversification across multiple companies, it does not protect investors from market-wide risks. Market risk includes factors such as economic downturns, geopolitical events, and other macroeconomic conditions that can affect the entire stock market. For example, in a recession, broad indices are likely to decline, regardless of the composition of companies they hold. Since index funds track the market as a whole rather than focusing on individual companies, they lack the flexibility to mitigate these market-wide risks through strategic allocation changes or selling underperforming stocks. This creates a challenge for index investors, as they remain vulnerable to the fluctuations of the broader market.

3. Interest Rate Risk

Changes in interest rates can significantly affect index investments, particularly during periods of rising rates. In recent years, the U.S. Federal Reserve has increased interest rates in response to inflation, and further rate hikes may occur if inflation rises again. Higher interest rates tend to lower stock valuations, as they raise borrowing costs and reduce the present value of future earnings. Interest rate risk particularly impacts high-growth companies, such as those in the tech-heavy S&P 500, which often rely on inexpensive debt for expansion. Continued rate hikes could squeeze returns on index funds, as companies contend with increased financing costs, potentially weighing on the performance of broad-market indices.

4. Overvaluation Risks

The heavy weighting of certain high-growth stocks in major indices can expose investors to overvaluation risks. When companies within an index trade at high valuations—often based on optimistic projections of future growth—disappointments in earnings or growth can lead to significant declines in stock prices, adversely affecting the index's performance. This risk is particularly pronounced when a few top-weighted stocks make up a substantial portion of the index. For example, if several top-weighted stocks in the S&P 500 are overvalued and experience corrections, this can disproportionately drag down the entire index. Investing in an index fund means inherently buying into both undervalued and overvalued companies, limiting the investor's ability to make strategic decisions.

5. Behavioral Biases in Selective ETFs

While index investing is often marketed as a form of “passive investing,” the rise of sector-specific and thematic ETFs has complicated this narrative. Investors can now choose ETFs that focus on specific sectors like technology, healthcare, or energy. Although these options allow for targeted exposure, they may also introduce biases that detract from the advantages of truly passive investing. By opting for sector-specific ETFs, investors might fall into behavioral traps, such as chasing trends or trying to time the market—actions that contradict the principles of passive investing. This can inadvertently introduce additional risk, as investors concentrate their portfolios based on perceived strengths in certain sectors rather than maintaining a diversified, market-wide approach.

6. Deflationary Risks:

The Japan Scenario One of the most significant concerns for index investors is the risk of a “lost decade,” similar to Japan's economic stagnation in the 1990s and early 2000s. After a period of economic boom and asset inflation, Japan entered a prolonged deflationary period where the stock market struggled to achieve meaningful returns. Japan’s benchmark indices saw minimal movement over a decade or more, leaving investors with stagnant returns. If major economies were to experience a similar deflationary period, this could lead to an extended phase of underperformance for broad-market indices, creating a challenging situation for investors. Without the ability to seek out more promising assets, index investors could potentially see their portfolios stagnate or even decline in real value over an extended period.

Conclusion

Index investing presents several notable advantages, including diversification, reduced fees, and extensive exposure to market performance. Nevertheless, it is imperative to acknowledge the associated risks. Investors may encounter concentration within particular sectors and remain susceptible to fluctuations in interest rates as well as broader market vulnerabilities, all of which can adversely affect returns. Further complicating this investment methodology are behavioral biases and the potential onset of deflationary stagnation, which contribute additional uncertainty to what is often perceived as a passive strategy. Consequently, investors are encouraged to meticulously evaluate these risks and ascertain whether index investing is consistent with their financial objectives and risk tolerance. While index funds can serve as a valuable component of an investment portfolio, adopting a diversified investment strategy that encompasses a range of asset classes and potentially includes actively managed funds may serve to mitigate some of the inherent risks linked to a solely passive approach.